The flat-tax flimflam

looks at the latest infatuation of Republican presidential contenders.

THE REPUBLICAN presidential candidates are coming down with a bad case of flat-tax fever--and working people better hope it doesn't spread, because we'd feel the pain.

Once confined to the conservative fringes of mainstream politics, the flat tax is all the rage among Republicans right now. The term is used to describe different proposals, but all are supposedly simpler and fairer than the existing system because they would set a single, or flat, tax rate in various forms, and get rid of the credits and loopholes that currently litter the tax code.

And voilà, says Texas Gov. Rick Perry, repeating the words his handlers have tried, with limited success, to drill into his not-so-Texas-sized brain--we'll all be figuring out our taxes "on that postcard right there."

If you're a SocialistWorker.org reader, you're probably reaching for your wallet about now--and you're right. The flat tax is nothing more than a gimmick to repackage the drive to cut taxes for the rich.

In reality, most of the flat-tax proposals would lead to a significant tax increase for a majority of people in the U.S. All would blow a bigger hole in the federal budget, providing the politicians--Democrats as well as Republicans--with more excuses to slash away at social programs that benefit working people and the poor.

But the thing that matters to the candidates running for the Republican presidential nomination is that any flat tax plan, no matter how half-baked, seems to appeal to the conservatives who will vote in the primaries beginning in a few month's time.

That would explain why former Massachusetts Gov. Mitt Romney declared in August, "I love a flat tax." Back in 1996, he was so perturbed by the flat-tax proposal of then-GOP presidential hopeful Steve Forbes that he personally took out an ad in the Boston Globe to denounce Forbes' "tax cut for fat cats." Now, though, Romney needs some primary voters to go along with the massive sums of cash he's raised for his campaign--so he's, ahem, rethought his position.

Perry jumped on the bandwagon in October with a scheme for a 20 percent flat income tax. Ex-House Speaker Newt Gingrich wants 15 percent. Michele Bachmann says her "flat tax" would have several different rates--which means it wouldn't, in fact, be "flat," but she at least got to say "flat tax."

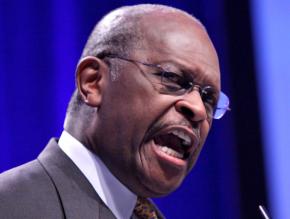

But the Republican presidential candidate most associated with the flat tax is Herman Cain, the former business executive and motivational speaker who, incredibly, has jumped from the crackpot fringe of the Republican race to front-runner. A little over two months before the first primary contests begin with the Iowa caucuses, Cain is leading in the national polls.

MANY OF the contenders for the Republican presidential nomination are trying to position themselves as the candidate of the right-wing Tea Party movement. But Cain really is a creature of the Tea Party.

From 2006 until he declared his candidacy this year, Cain was a mouthpiece for the billionaire-backed Americans for Prosperity (AFP), one of the various well-funded, establishment-connected, conservative groups that lurk behind the supposedly "grassroots" and "populist" Tea Partiers.

AFP was set up by the Koch brothers, the heirs to an oil fortune who are tied for 18th place on the Forbes magazine list of the world's billionaires. In 2010, the group funneled $45 million to various right-wing candidates and causes. One of those candidates was Republican Gov. Scott Walker, who did the Kochs' bidding in Wisconsin with a scorched-earth assault on public-sector workers and the labor movement.

Though already a specialist in self-promotion, Cain got a leg up from AFP when the group toured the former Godfather's Pizza CEO around the country. Using these connections, Cain was able to speak at more than 40 Tea Party rallies last year, hitting all the early primary states.

Cain's campaign manger Mark Block--now famous for his bizarre appearance in an even more bizarre Cain campaign commercial--was also on the AFP payroll. Likewise with Cain's top economic adviser Rich Lowrie, an AFP advisory board member who also dispenses investment tips for a Wells Fargo subsidiary. Lowrie is credited with coming up with Cain's "9-9-9" tax plan.

9-9-9 is the flat tax according to Herman Cain--get rid of the current individual income tax, corporate income tax, payroll tax, and estate and gift tax, and replace them with a 9 percent "national sales tax," a 9 percent "business flat tax" and a 9 percent "individual flat tax."

It doesn't take much looking to see who makes out from Cain's proposal. According to Citizens for Tax Justice (CTJ):

If presidential candidate Herman Cain's proposed "9-9-9 tax plan" was in effect today, then the richest 1 percent of taxpayers would each pay $210,000 less in annual taxes on average, while the poorest 60 percent of taxpayers would each pay about $2,000 more in annual taxes on average than they do now.

What's more, under a 9-9-9 plan, the federal government would collect about $340 billion less in revenue this year alone, according to CTJ researchers. That means a bigger federal deficit, which can be exploited by politicians to demand even harsher cuts and austerity measures than have already been imposed. Republicans shamelessly ignore the role that the Bush-era tax cuts for the rich played in causing the U.S. government's massive deficit--and the Democrats shamefully cave again and again to demands for austerity to reduce the deficit.

But why would most people be paying more in taxes if Cain's 9 percent flat rate on individuals is less than the rate for the lowest income tax bracket currently? Because of the 9 percent national sales tax, for one thing. This would come on top of sales taxes imposed by state and local governments.

A consumption tax like this is called a regressive tax because it hits people harder the lower they are on the income scale. Everybody pays the same tax rate on purchases, but lower-income people spend a much larger part of their income on the goods and services that get taxed--therefore, a larger share of their total income goes to such taxes.

As Len Burman of the nonpartisan Tax Policy Center put it:

[Consumption] spending falls as a share of income as income rises. Low-income people spend all their income or more. High-income people spend only a tiny fraction...[A] flat tax inevitably exempts most of the income of high-income people from tax. If it is going to raise the same amount of revenue as the current system, it must raise somebody else's taxes. That would be low- and middle-income people.

And besides, Cain's proposal for income taxes on individuals would scrap tax breaks like the Earned Income Tax Credit (EITC) and child tax credit that allow the poor and working poor to pay nothing in income taxes. If Cain got his way, households that are struggling the hardest to get by would get taxed on their income at the same rate as the very richest Americans, while getting gouged for a much greater portion of their income by consumption taxes.

In other words, Cain's 9-9-9 fantasy, if it ever became reality, would steal from the poor and workers to give even more to the rich--like his patrons, the Koch brothers.

CAIN'S CLIMB into the top ranks of the Republican presidential race inevitably put the words "flat tax" on every GOP candidate's lips.

For example, after being required to open his mouth in several debates, Rick Perry went from front-runner to laughingstock, so he's now trying to revive his campaign with his own flat-tax flimflam. Instead of three 9s, Perry uses two 20s--a flat 20 percent income tax and a flat 20 percent corporate tax.

The Perry proposal has a twist, though--individuals could choose between the flat income tax of 20 percent, or stick with what they pay, or don't pay, under the current system.

This is the height of campaign pandering. No one would pay more in taxes than they do now, not even the poor and working class people who would be hit under the Cain plan by the national sales tax and scrapped credits like the EITC--they could simply opt for the current system. Meanwhile, the rich would make out like bandits--particularly since Perry's new plan would entirely eliminate the capital gains tax on income from investments and dividends.

Instead, the federal government would be further starved of tax revenue. So wealth would still be redistributed from poor to rich, but in the form of the inevitable cuts in spending on government programs that working people depend on. Perry, remember, thinks that Social Security, Medicare and Medicaid are unconstitutional, and the equivalent of a giant "Ponzi scheme"--so it doesn't exactly come as a surprise that his tax plan would set them up to be slashed eventually.

Like any candidate, Perry has kept quiet about certain incriminating details in his proposal. But even so, it isn't hard to see who benefits. According to Citizens for Tax Justice, Perry's plan:

would not make anyone's life easier on tax day--except the wealthy Americans whose investment income would be exempt from taxes under Perry's optional flat tax. These lucky taxpayers would quickly find that the optional "flat tax" actually has two tax rates: zero percent for the investment income that mostly goes to the rich and 20 percent for the types of income that most of us depend on.

Perry isn't trying to hide the fact that he wants to make the already rich much richer--he's proud of it. When the New York Times' John Harwood pointed out while interviewing Perry that "those at the top" would rake in "hundreds of thousands, maybe even millions of dollars" from his tax plan, Perry responded:

But I don't care about that. What I care about is them having the dollars to invest in their companies. To go out and maybe start a business because they got the confidence again, because they actually get to keep more of what they work for.

PERRY'S STATEMENT reveals something important about the whole Republican flat-tax society. The justification for the flat tax is that putting more money in the hands of corporations and the wealthy is the way to spur economic growth and create jobs.

Only it isn't--and the last decade has provided especially vivid proof.

Remember back to the Bush tax cuts, passed in two installments in 2001 and 2003, at a cost of $1.3 trillion over 10 years. The main point was to reduce the tax rate at different income levels, including the top marginal rate that kicks in for income over $400,000, which decreased from 39.6 percent to 35 percent.

That's where the big bucks got made. According to estimates at the time, the richest 1 percent of the population stood to gain 43 percent of the total tax relief--that is, more than half a trillion dollars over the next decade.

So did that money spur economic growth and create jobs in the 2000s? Far from it. Even during the years when the U.S. economy was expanding, job creation was anemic--leading writers to call the period the "jobless recovery."

Instead, as SocialistWorker.org later recounted, "large parts of the Bush tax cuts for the rich ended up being gambled away in the Wall Street casino, contributing to the financial bubbles that burst in 2008. As far as the good of society as a whole is concerned, that money was flushed down the toilet."

Corporate America today isn't creating jobs at anywhere close to the pace needed to make up for the losses of the recession, but the reason isn't a lack of capital. According to a recent report by the Moody's ratings agency, the 1,600 U.S.-based companies it rates had a total of $1.2 trillion in cash on hand at the end of 2010, almost 50 percent more than their hoard at the end of 2007, when the recession officially began.

But companies aren't making the kind of investments that open new factories or create new jobs because they don't see an opportunity for profit. During the summer, a survey by CFO magazine of chief financial officers at 500 U.S. companies found they planned to increase the number of full-time employees by a measly 0.7 percent over the next year--about the same number of jobs needed just to keep up with population growth, say economists.

No one should fall for the Republican flat-tax fraud. Their goal isn't promoting fairness or simplicity or wanting to create jobs--but paving the way to stuff more money in the pockets of the already rich.