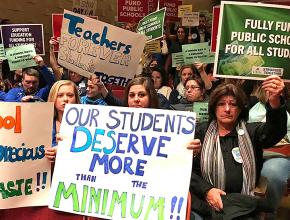

Starving Connecticut’s schools

Connecticut teacher reports on the state's crisis of education funding.

LAST FALL, Democratic Gov. Dannel Malloy and the Connecticut state legislature passed a budget that punishes public education.

Public schools receive the vast majority of their funding through both municipal tax revenues and state grants called Education Cost Sharing (ECS) grants. According to the Connecticut School Finance Project, statewide, ECS grants account for 27 percent of funding for public schools. But many public schools expect far more than that from ECS grants.

This funding is critical for public schools to operate, since many municipal tax bases are reliant on property taxes. Especially since the 2008 financial crisis, middle-income homeowners in smaller towns have often been pitted against increases in school funding, because this means their property tax bills will go up. Consequently, school funding has hit a wall in terms of increasing revenue through the municipal tax base.

There is an alternative: Tax revenue could be drawn from the larger state pool by taxing the rich. However, Malloy and the Connecticut state legislature are moving in the opposite direction and attacking the very sources of funding that are keeping Connecticut schools operating.

FOR THE current fiscal year, Connecticut schools will see approximately $90 million less in ECS grants from the state. The Griswold school district, in which I teach, has already seen a $1.4 million cut in state funding for the current school year. For the 2019 fiscal year, the same district is projected to receive a total of $1.3 million less than what it would have received in funding under the old formula.

Many towns throughout Connecticut are experiencing the same shortfalls, leading them to consider drastic cuts. Although Malloy and the state of Connecticut have come up with a new formula for allocating state money to schools, the overarching theme is that every school will experience cuts to funding.

"Alliance District" schools--schools that the state considers "high needs" and which are in the 33 lowest-performing school districts, predominantly in urban areas--will see ECS funding cuts of between 0.12 to 2.3 percent, compared to the old funding formula. Non-Alliance school districts, predominately suburban and rural schools, will see funding cuts of between 13 and 75 percent.

On the surface, one might think that these schools can afford these cuts. By not drastically cutting funding for Alliance District schools, Malloy has promoted this idea as a way to blunt opposition to austerity.

The reality is different. The school district in which I teach is a predominantly rural and working-class district, even if it is classified as middle income. Since 2008, the number of students in the district who qualify for the Free or Reduced Lunch program has risen from 26 percent to 38 percent. In addition, the percentage of the population that falls under the federal poverty line has increased.

Having $1.3 million less in state funding for the 2019 fiscal year will amount to a 13 percent cut in ECS funding. This would be devastating.

At the same time, student needs have also increased throughout the state. The number of students who qualify for special education services and those who are English language learners has increased.

The justification for austerity is that there isn’t enough money in the state's general fund, and something has to be cut. If we accept this logic, we will certainly lose funding for our schools.

Funding can and should be increased. The only way this can be done is through progressive taxation of the richest people in Connecticut.

The common objection to this is that taxing the rich will cause them to flee the state. However, we can’t see our power as lying solely within the borders of our single state. We must look beyond our state and even our country to raise demands that the rich be taxed in order to fully fund needed education and social services.

If the rich leave, tax them wherever they go. If we don't tax them, the result is the same, and we will have accepted cost-cutting as the only solution to the crisis. Our fiscal reality demands that we not have too narrow a view.

Trump's federal tax overhaul, a boon for the rich, is shaping the cost-cutting that is going on at the state and local level. This is all designed to keep the U.S. as a "strong economy" relative to its competitors and continue to allow the U.S. to wield its influence in the affairs of other nations around the world. Certainly, the maintenance and expansion of military spending is part of this.

Capitalism manufactures crisis. Crisis is the shock that is used to extract more and more from those who have less: the working class. We have to firmly stake out our ground: No more cuts to education! Tax the rich!