Blank check for the bankers

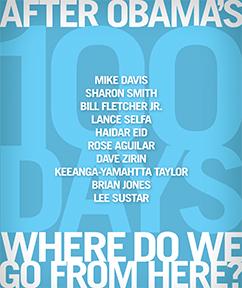

Millions of people looked forward to Barack Obama's presidency with a sense of pride and hope. But Obama's first 100 days have raised critical questions about the limits of what we can expect from a Democrat in the White House--and what it will take to get the change we want.

What do you think of Obama's 100 days? And what does the left need to do now to move the struggle forward? We asked a group of writers and activists for their answers to these questions. This commentary is from , a frequent writer about economics and labor issues for SocialistWorker.org and contributor to the International Socialist Review.

MANY ON the left were unsurprised that Barack Obama has maintained the Bush administration's imperial project in the Middle East and escalated the war in Afghanistan. But perhaps more were shocked that Obama's approach to the banking crisis is to be even more generous to the bankers than Bush. Effectively, Obama has simply handed the bankers a blank check from the Treasury, with just a few conditions on executive pay to make it more politically palatable.

Even where bailouts have given the government enough shares in company stocks to control them--such as at insurer AIG and Citibank--the Obama administration has done everything it could to avoid taking outright control in order to leave private capital in charge.

Of course, Obama has advanced elements of a break with the free-market, neoliberal economic policies of Reagan-Bush-Clinton-Bush. The scale of the crisis has given him little choice: government must substitute for consumer spending and business investment. Obama's budget sets aside $634 billion over 10 years for increases in health care, and the rich will have to be taxed more highly to pay for it.

Yet as Chuck Collins of the Institute for Policy Studies points out, the effective top tax rate paid by those with incomes of more than $2 million (in 2006 dollars) has been cut in half since 1955--a year when a Republican, Dwight Eisenhower, was in the White House. By the standards of today's Republican Party, Eisenhower, the former head of Allied forces in the Second World War, was a flaming socialist radical.

In fact, by refusing to aggressively tax the income--and accumulated wealth--of the rich, Obama has undercut his bold rhetoric on economic policy. And his recent order that federal agencies cut $100 million from the budget is a bow to Democratic moderates and the Republicans. This follows a far more serious compromise over the stimulus plan, which was skewed toward relatively ineffective tax cuts rather than social spending, and pulled back on aid to budget-strapped states.

THE ADMINISTRATION'S hope seems to be that an early economic recovery will allow it to avoid hard choices over aggressive government spending and "fiscal responsibility." Indeed, the end of Obama's first 100 days comes as administration officials are signaling the beginning of an economic recovery. The recent rally in the stock market seems to support that claim, as do big earnings at Wachovia, Citibank and other huge banks.

But the best that can be said about the U.S. economy is that it isn't as deteriorating as fast it was a few weeks ago. The pause in economic decline is due largely to the cash tsunami created by the Federal Reserve as well as the $700 billion in bank bailouts and Obama's $787 billion stimulus plan. CNN tallied up the various spending packages, loans, loan guarantees and other spending commitments, and came up with a figure of $10.5 trillion. By comparison, annual U.S. economic output is about $14 trillion.

With that much cash sloshing around, there's bound to be some bounce-back in economic activity. And the administration is desperately hoping that this recovery takes hold in order to lower the political temperature over the various bailout schemes. They worry that the outrage over bonuses paid to executives at the nationalized insurance company AIG will lead to popular opposition to Treasury Secretary Tim Geithner's plan to cover banks' losses by having the government subsidize big private investors' efforts to purchase toxic securities.

Finally, an economic recovery--even it does emerge sooner rather than later--won't address the long-term problems of the U.S. and the world economy. This recession isn't just another economic downturn that's endemic to capitalism. Rather, it's a crisis of the entire neoliberal economic model of free trade, privatization and "flexible" (read: low wage) labor.

This model could flourish as long as U.S. finance capital (and its enforcers in the World Bank, International Monetary Fund and World Trade Organization) were capable of penetrating new areas of the globe and extracting concessions from local capitalists. It survived the East Asian financial crisis of 1997-98 only when the U.S. stepped in to become the importer of last resort, thanks to debt-based consumer spending based on low interest rates.

Now, of course, U.S. consumer spending will be minimal for the foreseeable future, and U.S. financial giants have fallen. What's needed--even in capitalist terms--is a far-reaching program to restructure the economy on a more stable basis, based on a revival of production. Instead, Obama's program is try and resuscitate a failing financial system while simply nudging private capital towards more U.S. investment.

The crisis ensures that the debate will continue, however. Early recovery or not, unemployment is likely to keep rising for months to come. The left must be prepared to use that opportunity to open a wider debate on economic priorities--and get organized to fight for them.